Table of Content

HSBC is doubtless certainly one of the largest world banks providing financial companies like wealth, personal and, commercial banking in over sixty three international locations. Having the right combo of bank accounts can help you manage your cash higher by taking advantage of different perks. Start small, by automating savings to a high-yield savings account.

It might take one or two days to transfer money from your HISA to another account, and you would possibly have to pay a fee for e-transfers from your HISA account. When you deposit your cash into an account at a financial institution or different financial institution, they may lend these funds to different clients. You have access to your money at any time, and to reward you for maintaining your money in the account, the financial institution pays you a sure price of curiosity. A high-interest financial savings account merely offers a more attractive rate of interest than other savings accounts that may be supplied by the establishment. The rate of interest is applied to the entire steadiness in your account and is typically calculated day by day but paid out monthly.

Apy: 300%; Minimal Deposit: $100

To be on this listing, the savings account should be nationally available. Note that you should open a Varo checking account, known as a Varo Bank Account, before you can start a savings account. You'll also need to financial institution with one other establishment if you'd like to open a joint checking account. Kailey Hagen has been writing about small businesses and finance for almost 10 years, with her work appearing on USA Today, CNN Money, Fox Business, and MSN Money. She makes a speciality of private and business financial institution accounts and software for small to medium-size companies. She lives on what's almost a farm in northern Wisconsin with her husband and three dogs.

You’ll need to make your initial deposit within 60 days of account opening – in any other case your account could possibly be closed. You don’t must make a gap deposit to open this account. The Popular Direct High-Rise Savings account earns a competitive yield.

Cfg Financial Institution, Excessive Yield Money Market Account – Four00% Apy

The fundamental difference between a high-yield and money market account is the convenience of access to your savings. Typically, most high-yield accounts do not come with a checkbook, whereas a money market account does. Some high-yield accounts don't have monthly fees or steadiness necessities. For example, for example you are saving up for a visit to Bali next yr, and you will want $2,000 to make it occur. If you fund a high-yield savings account with a zero.60% APY with a $100 initial deposit, you'd have to put about $160 within the account every month for 12 months to save the $2,000. Many online banks supply the highest interest rates as a end result of they don't appear to be topic to the identical overhead prices as brick-and-mortar banks.

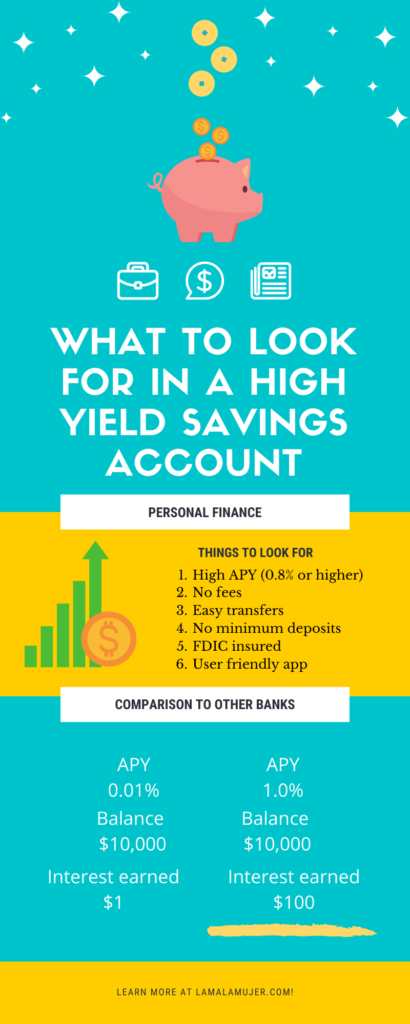

One of the most important concerns when selecting a high-yield financial savings account is the APY. Matthew has been in financial services for more than a decade, in banking and insurance coverage. A high-interest financial savings account, however, typically doesn't come with checks, though it'll still provide a powerful APY. The U.S. authorities similarly backs credit union prospects up to $250,000 by offering NCUA insurance to the overwhelming majority of credit score institutions.

Who Should Get A High-yield Savings Account?

She has an MBA and a bachelor's degree in public relations, in addition to hundreds of articles revealed online by The Balance, Finder.com, Money Under 30, Clever Girl Finance, and extra. All account data and APYs, or annual proportion yields, are accurate as of Dec. 1, 2022. If you do not meet the necessities, you may solely earn 0.01% APY in your account stability.

Access your money immediately by way of transfers to linked accounts, Interac e-Transfer, and extra. Service charges are listed on-line and embody a $1.50 cost to ship an Interac e-Transfer®. Service fees are restricted to a $45 cost for non-sufficient funds. Service fees are listed on-line and include a $20 cost for dishonoured cheque or pre-authorized debit reversal charge. 2.35% bonus rate of interest for the first 4 months if you open your first account (up to a steadiness restrict of $1,000,000).

A traditional financial savings account is one various to a high-yield account. While these accounts don't offer the identical excessive APY or compounding interest, they do present some interest. Most credit score union accounts or bank accounts with a standard savings construction provide interest rates across the 0.10% mark.

Note that some banks choose to name their financial savings accounts "cash market" accounts. Traditionally, money market accounts supply the power to write down checks, while financial savings accounts don't. The accounts you will discover in our ranking right here all function like savings accounts, with no check-writing privileges, even if the name may recommend in any other case. NerdWallet Canada selects the best high-interest savings accounts based mostly on a quantity of standards together with annual share yields, minimum balances, charges, digital experience and extra.

You’ll earn a aggressive yield on a High-Yield Savings Account at BrioDirect. You only want $25 to open this account and it doesn’t charge a monthly service fee. Checking accounts are greatest for people who want to hold their cash secure while still having straightforward, day-to-day entry to their funds. CDs are finest for individuals in search of a guaranteed rate of return that’s usually larger than a financial savings account. In change for the next rate, funds are tied up for a set period of time and early withdrawal penalties could apply.

HISA can be included in TFSAs, RRSPs, RRIF or different registered plans. To be eligible, you must be a Canadian resident who is the age of majority in your province or territory. If you’re underneath the age of majority, apply by visiting a CIBC Banking Centre. $1 per month paid to you if you choose to obtain your paperwork electronically. 3.00% interest for balances underneath $5,000,000, and 0.50% interest for balances $5,000,000.01 and over. The Canadian Investor Protection Fund (“CIPF”) provides safety in your accounts in case of insolvency for as much as $1 million per account kind.

Yes, positive aspects generated by a high-interest financial savings account will be taxed yearly. Every year, your bank will ship you a T5 slip that reveals your curiosity earnings. You should submit this kind alongside along with your other earnings when you file your taxes.

High-yield financial savings accounts can yield hundreds of times more these days. High-yield savings accounts allow you to earn a competitive annual share yield on your cash. They often earn many instances the yield of the typical financial savings account. Some banks could cost a charge or restrict the variety of withdrawals or transfers you could make per statement cycle. Voi bank is a web-based savings account with out brick-and-mortar banks. The easiest method to deposit money into your Vio bank account is thru electronic switch from a linked checking account.

No comments:

Post a Comment